Michael Knight Had it Right: The Future of Telematics and Insurance Analytics is Here

Michael Knight Had it Right: The Future of Telematics and Insurance Analytics is Here

By Michael Schwabrow

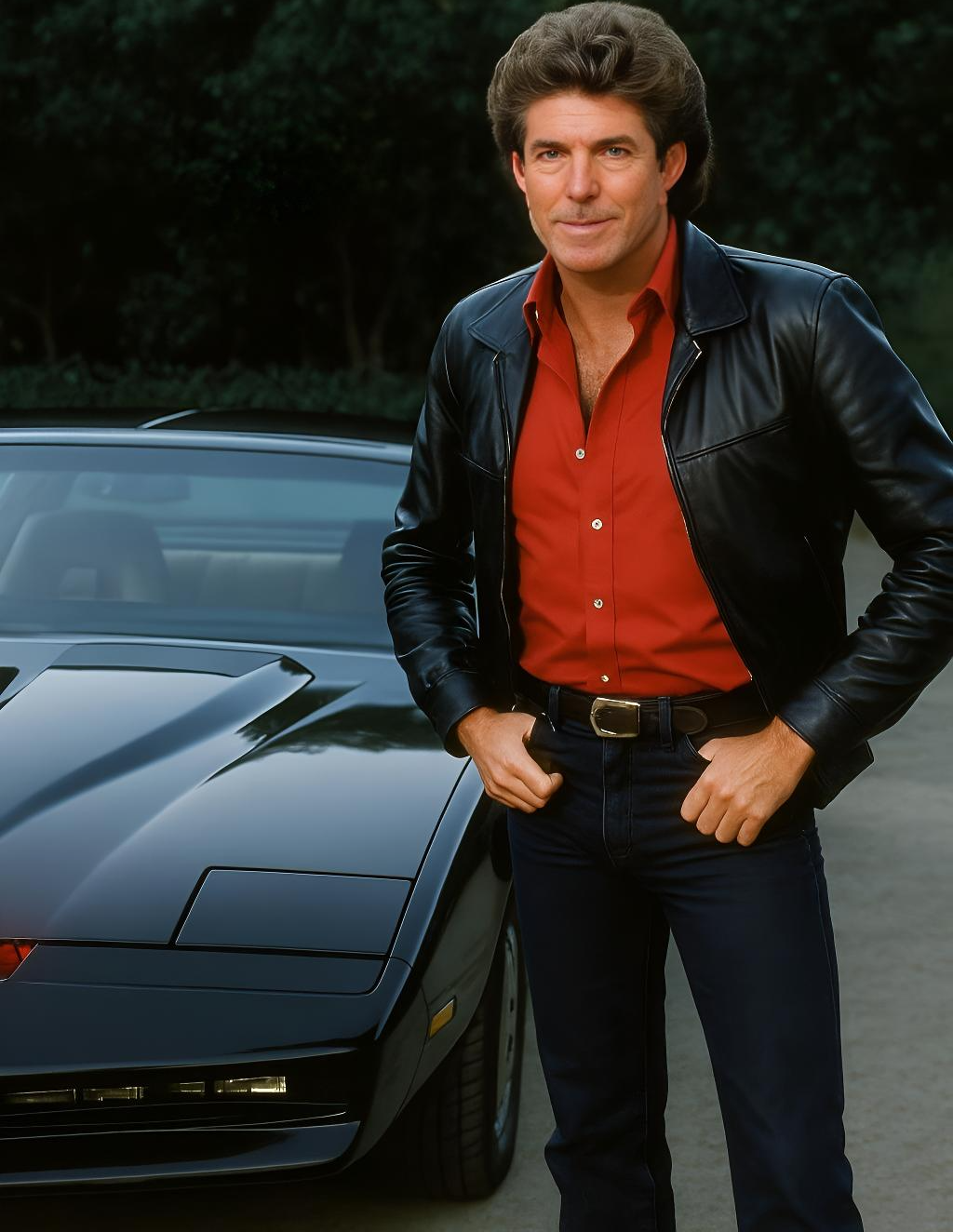

Before smartphones, smartwatches, or smart cars, there was KITT—a black Pontiac Trans Am with a mind of its own. Equipped with AI, voice command, self-driving capability, and constant system diagnostics, KITT was more than a car.

Sure, Michael Knight’s character helped bring the series to life, but it was KITT’s futuristic sensors, communication systems, location tracking, and autonomous driving that left a lasting impression.

What seemed like science fiction then is now starting to take hold around the world.

Today’s Tesla Model S offers advanced driver-assistance features like Autopilot and Full Self-Driving (FSD), GM’s OnStar has been providing crash response since 1996, and Progressive’s Snapshot program uses telematics to adjust insurance rates for millions of drivers. While today’s smart cars may be less action-packed than KITT, the foundational technologies are remarkably similar.

The Potential for More Than Just GPS Tracking

Today’s telematics ecosystem has lots of room for growth and innovation. According to Spherical Insights, the global automotive telematics market was valued at approximately $83.45 billion in 2023, with usage-based insurance (UBI) programs leading adoption. Progressive reports that their Snapshot customers save an average of $322 annually.

But current telematics barely scratches the surface. Most programs still rely on basic metrics—speed, braking patterns, time of day—transmitted to cloud servers for batch processing. The real transformation lies ahead.

Edge Intelligence and The Future of Connectivity

Edge-based telematics represents the next evolutionary leap in vehicle technology.

Imagine an in-vehicle analytics platform loaded on an Edge telematics system capable of making immediate decisions to avoid collisions or alert emergency services of the high likelihood of a crash.

This type of local intelligence could reduce insurance fraud, speed up claims processing, and ultimately help save lives. Mercedes-Benz’s PRE-SAFE® system exemplifies this approach by initiating full braking approximately 0.6 seconds before a potential impact if the driver fails to respond to warnings.

Advanced analytics and telematics become more important as we approach the rollout of 6G networks by 2030, where nearly every device—from traffic signals to roadways to pedestrians—can be connected. We could see entirely new dynamics around liability and risk scoring. Samsung’s 6G research envisions latency under 0.1 milliseconds—potentially enabling true real-time vehicle-to-everything (V2X) communication.

Your smartwatch might vibrate to alert you that a vehicle nearby is behaving erratically. That’s not science fiction, it’s a plausible outcome of hyperconnected telematics ecosystems already being tested in smart cities across Europe and Asia.

Analyzing Emotion

One of the most interesting recent developments in telematics is biometrics. Companies like Affectiva have developed Emotion AI technologies that sense driver fatigue, distraction, and emotional stress through facial analysis and voice patterns.

Volvo’s upcoming EX90 will feature a Driver Understanding System that uses cameras to monitor eye movement and head position, automatically adjusting driving assistance based on attention levels.

These are just two examples of where emotions, telematics, and analytics could make driving safer.

However, there will be data privacy regulations to manage for widescale adoption. The European Union’s GDPR and California’s CCPA already regulate how this sensitive information can be collected and used. Analytics that clearly show the insights that insurers and automakers are using could be influential towards telematics innovation that checks all regulatory boxes.

The Analytics Challenge: From Data Wasteland to Insight

Here’s where many current telematics programs fall short. According to a 2020 study by Seagate and IDC, 68% of enterprise data goes untapped—and telematics data is no exception. While this figure is a few years old, the insurance industry often lags behind on data transformation. In all likelihood, we’re still stuck near that benchmark today—sitting on a vast well of underutilized vehicle insights that could reshape underwriting, claims, and risk scoring if properly activated.

Allstate’s Drivewise program is one of the programs at the forefront in this area using phone sensors. It combines telematics with analytics to monitor driving behavior. Research indicates that customers who opt into Drivewise are 25% less likely to be involved in severe collisions compared to those who don’t, highlighting the program’s potential in promoting safer driving habits.

The key is creating systems where data insights inform immediate action. Root Insurance has built its business model around this principle, using continuous telematics monitoring to dynamically price policies. The company has reported improvements in its gross accident period loss ratio, aligning with their goal to bring gross accident period loss ratios below 60%.

KITT meets Modern Insurance

Instead of reacting to incidents, insurers could foresee them based on weather patterns, road conditions, and surrounding driver behavior. One insurer working with Tomorrow.io reportedly saved thousands per hail claim by sending proactive weather alerts to policyholders ahead of severe weather events.

A driver’s risk profile could change minute-to-minute based on location, time of day, and nearby driver behavior. A responsible driver in optimal conditions might pay less per mile, while the same driver with higher risk score could see a temporary price increase in the same scenario.

Future systems could elevate safety by overriding driver control when imminent danger is detected. Volvo’s City Safety system already prevents rear-end collisions at low speeds, but next-generation systems will coordinate with other vehicles and infrastructure to manage complex scenarios.

Industry Collaboration: The Path Forward

Success requires strong collaboration between traditionally separate industries. Here are a few examples:

- Ford and State Farm are developing integrated telematics solutions where insurance is embedded to monitor driving habits and mileage.

- BMW and Allianz created a joint venture to offer usage-based insurance.

- Toyota and Aioi Nissay Dowa launched Japan’s first fully integrated automotive-insurance ecosystem.

These collaborations work because they embed advanced analytics with telematics from the ground up. The most successful programs treat insurance, telematics, analytics, and vehicle systems as a unified ecosystem.

The Road Ahead

We’re approaching a point where the distinction between vehicle and insurance becomes increasingly blurred. Cars won’t just transport us, they’ll actively manage our risk profiles, prevent accidents, and streamline claims processing when incidents do occur.

The winners in this transformation will be insurers that view telematics with advanced analytics not as a cost center or compliance requirement, but as a strategic advantage that can improve customer experience while reducing operational costs. This future is not limited to the big insurers that everyone sees on the TV, all auto insurers can start on this path. This is a transformation that could redefine auto insurance.

KITT may have been fiction, but the intelligent, connected, protective vehicle it represented is rapidly becoming reality. The question isn’t whether this future will arrive, but which companies will lead its development and deployment.

We may not all be riding with KITT, but the cars of tomorrow won’t be far off.

Check out our Platform section for more details on our services.