P&C Insurance Analytics

The Cloverleaf Insurance Intelligence platform enhances P&C insurer performance via GenBI, ML, and other technologies for greater growth, customer experience, and risk mitigation.

Vendor-agnostic platform that can be used with Pyramid Analytics, Microsoft PowerBI, and Qlik.

Carriers can improve their growth, efficiency, and profitability through advanced intelligence by simply verbally asking a question of the platform to determine where the business is exceeding goals or needs a boost to achieve key objectives. The company's commitment to advancing insurance intelligence ensures carriers are prepared to navigate challenges and shape the industry's future.

Cloverleaf enables carriers to inspect what they expect leading to sustainable growth.

Benefits of the Three BI Leaders that Cloverleaf Works with:

Pyramid Analytics

Query data from any source with 200+ connectors and 10X direct query performance over Tableau.

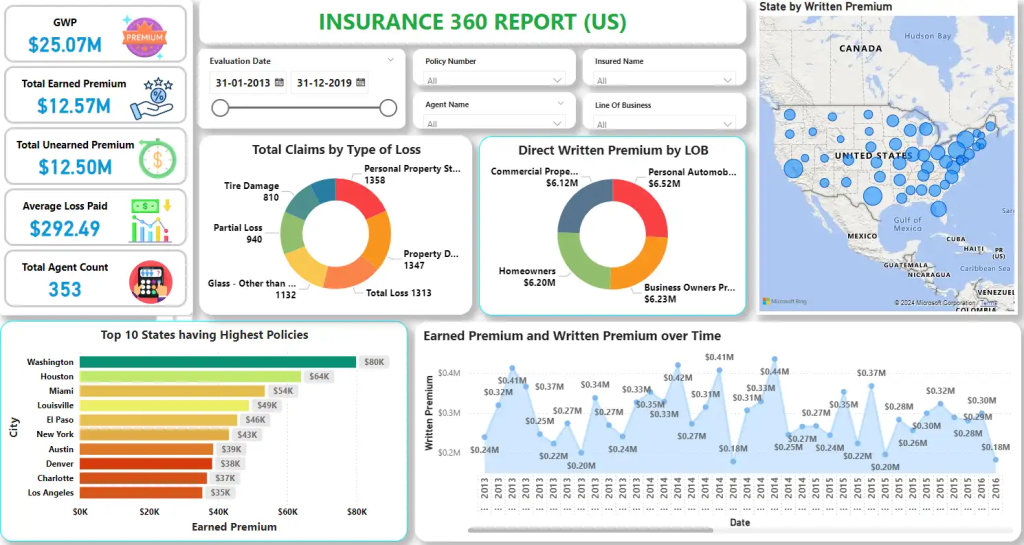

Microsoft PowerBI

User-friendly interface with dynamic reporting capabilities and extensive Generative AI features.

Qlik

Strong data modeling, integration, and exploration capabilities with quality dashboards.

The Value of Cloverleaf for Different Insurance Professions

Senior Executives

- Get access to vital information to support decision-making in 30 seconds without needing help from data scientists or actuaries.

- Extensive scalability enabling the rapid expansion of MGA partner networks.

- Advanced customization to help adjust to new business growth and profitability goals.

Claims

- Improve the accuracy and efficiency of claims processing to support strong customer satisfaction.

- Better understand the performance of every claims professional in an insurance business.

- Expedite decision-making while being able to have a clearer understanding of customer behavior.

Underwriting

- Streamlined research, documentation, and decision-making with instant access to insurance insights.

- Be a stronger partner of internal peers and external customers due to greater operational speed.

- Access to GenAI with the proper insurance-centric perspective to support underwriting operatins.